Financial Literacy Made Easy

If you’re looking into getting in the right mindset, starting an affiliate marketing campaign, a drop shipping website, crypto, stocks, or any other online business, you came to the right place. The right mindset is one of the first things you need before getting into these ventures.

Without the mindset, you will start many different ideas yet never get to finish them because the discipline and structure necessary to succeed is just a thought.

Do you ever find yourself inspired and fired up after seeing a couple of inspirational tutorial videos of a new program like affiliate marketing or dropshipping, or SMMA that will “Get you $2,345 within 24 hours!” You’re motivated and ready to go off of simply the idea that money will be guaranteed with these “Foolproof technique” videos, but how long will that last? A week? A month?

You may reach the milestone of 3 months of consistent effort and work, yet you need help to get something to work. You may need more financial fundamentals to create and keep profits consistently. But don’t you worry, friend! That is precisely what we will be going over today.

Today I’m going to be going over the book the 4 Most Important Lessons in Financial Literacy as written in “Rich Dad, Poor Dad” by Robert Kiyosaki, which detail the fundamental mindset lessons that separate those with wealth and those without.

If you’re tired of being like those without wealth and aspire to have an abundance and wealthy mindset, keep reading along.

Kiyosaki prefaces the book by describing his biological dad, or “Poor Dad,” as a brilliant man who believed in studying hard, getting good grades, and finding a well-paid job. (Looks like we were both finessed, “Poor Dad”). His “Rich Dad” was his best friend’s father growing up, yet he was the boss of his company who understood that financial literacy was essential and money should work for you and not the other way around.

“It’s fear that keeps most people working at a job:

Robert Kiyosaki

the fear of not paying their bills, the fear of being fired, the fear of not having enough money, and the fear of starting over. That’s the price of studying to learn a profession or trade and then working for money. Most people become a slave to money – and then get angry at their boss.”

Many of us can relate because this is exactly how our system is set up. This leaves us with two options. Quit and reject the system and play it safe, or take it on full steam ahead and conquer it. “Life pushes all of us around. Some give up. Others fight. A few learn the lesson and move on. They welcome life pushing them around. To these few people, it means they need and want to learn something. They learn and move on. Most quit, and a few like you fight.” – Rich Dad.

Lesson 1: “Use your emotions to think, don’t think with your emotions.”

“The poor and middle-class work for money. The rich have money work for them.”

Kiyosaki argues that fear motivates many to go to school to have enough to pay the bills. This leads to the fear of being fired, starting over, and being viewed as a failure. Many need to realize that authentic learning takes passion, energy, and burning desire. It is not until you get angry with your situation that you decide to change.

In the book, Rich Dad tests Kiyosaki and his best friend by having them work at his job for very little pay. They do this for weeks until they are fed up with his underpayment, and he explains that, like them, many adults eventually grow angry with their situation. Still, instead of analyzing the problem, they blame the boss, ask for a short-term raise, or outright leave for another company. They always need help figuring out that it is ultimately in their own hands to create wealth and opportunity.

Rich Dad’s next test offers the kids multiple exponential raises until they finally take them. He tells them that, like them, many adults also fall into the desire that keeps the perpetual pattern set in the rat race. The initial fear of not paying the bills, then the desire to spend our entire checks once we have them. If you’re like me, you’re exhausted.

You’re fed up.

Car payments, gas prices, monthly subscriptions, needing more money to make it through the next check.

You overspend for a day, leaving you with crumbs to live for a week. Rich Dad explains it’s due to falling victim to both the emotions of fear and greed that we continue the pattern.

“A job is a short-term solution to a long-term problem.”

What Kiyosaki really means when he says rich people have money work for them is rich people buy assets while the poor and middle class only use the time to earn money within a job. The rich understand that money is an illusion kept honest by these two emotions. Today’s money is being printed off the gold standard, meaning the government is just creating it out of thin air.

Rich Dad recommended they work for free until they could identify a way to make money work for them. They then created a business where they lent out comic books for a price and averaged triple what they made working there. Rich Dad could continue with his next lesson.

Lesson 2: “Your financial education is a far better asset than money.”

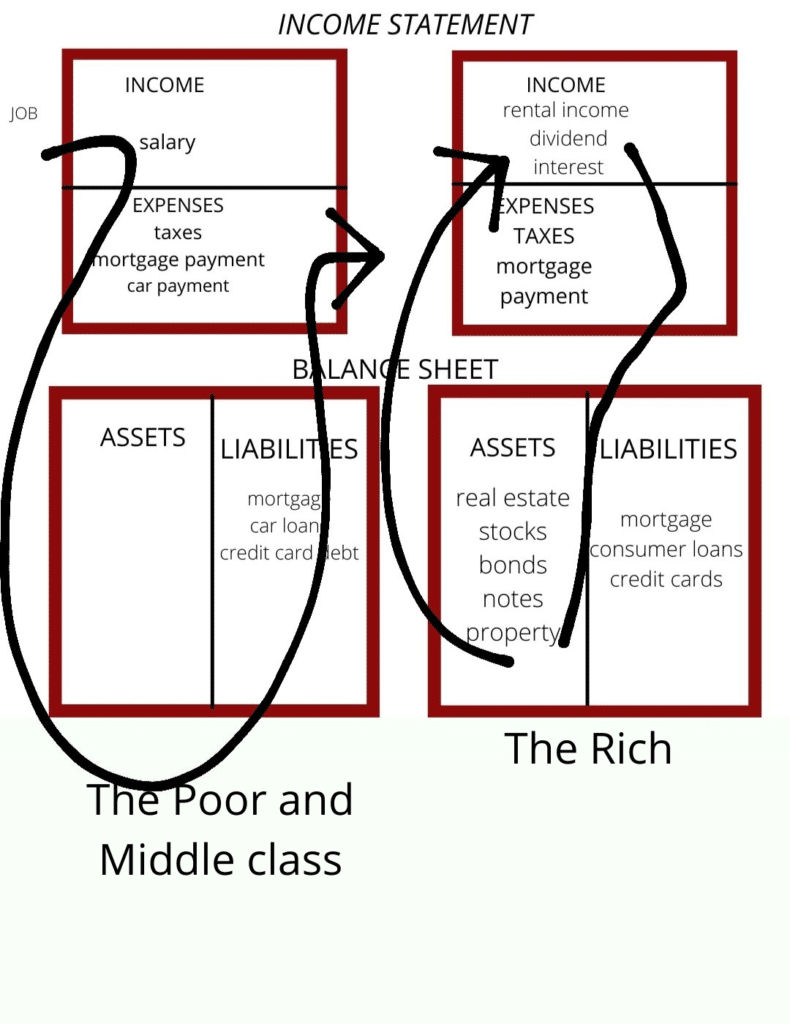

Rule 1 and the only rule. “You must know the difference between assets and liabilities and buy assets.” Assets put money IN your pocket. A liability is something that takes money out of your pocket.”

Money does not solve problems. In fact, it may actually accelerate them.

If a poor person were to suddenly win the lottery, it is expected they usually return to the same baseline as they spend the money carelessly. If your mental pattern is to spend all the money you get, an increase in cash would likely lead to a rise in spending.

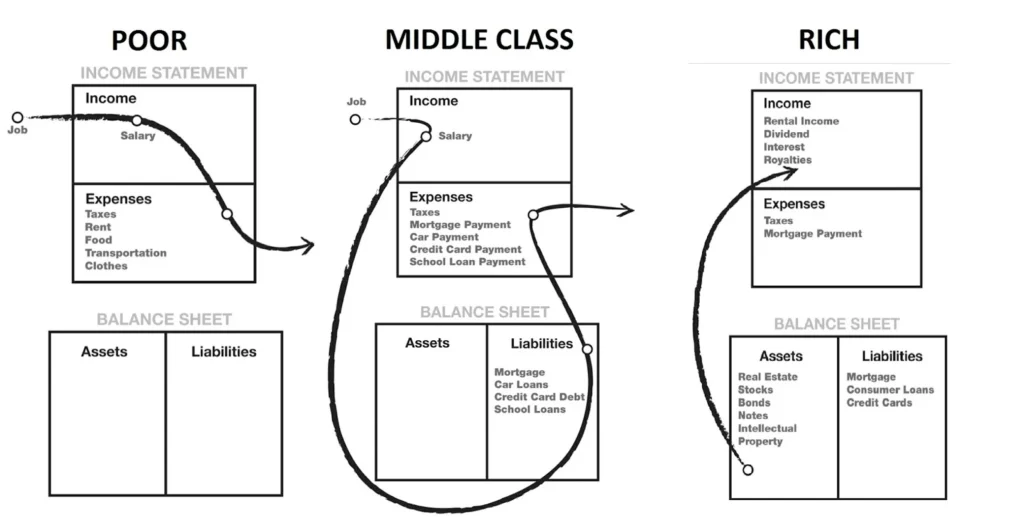

Below is what is known as a cash flow balance sheet

The poor receive an income based on a salary or fixed wage and use it all on expenses such as taxes, rent, food, and anything they may buy.

The middle class receives a higher income and buys liabilities.

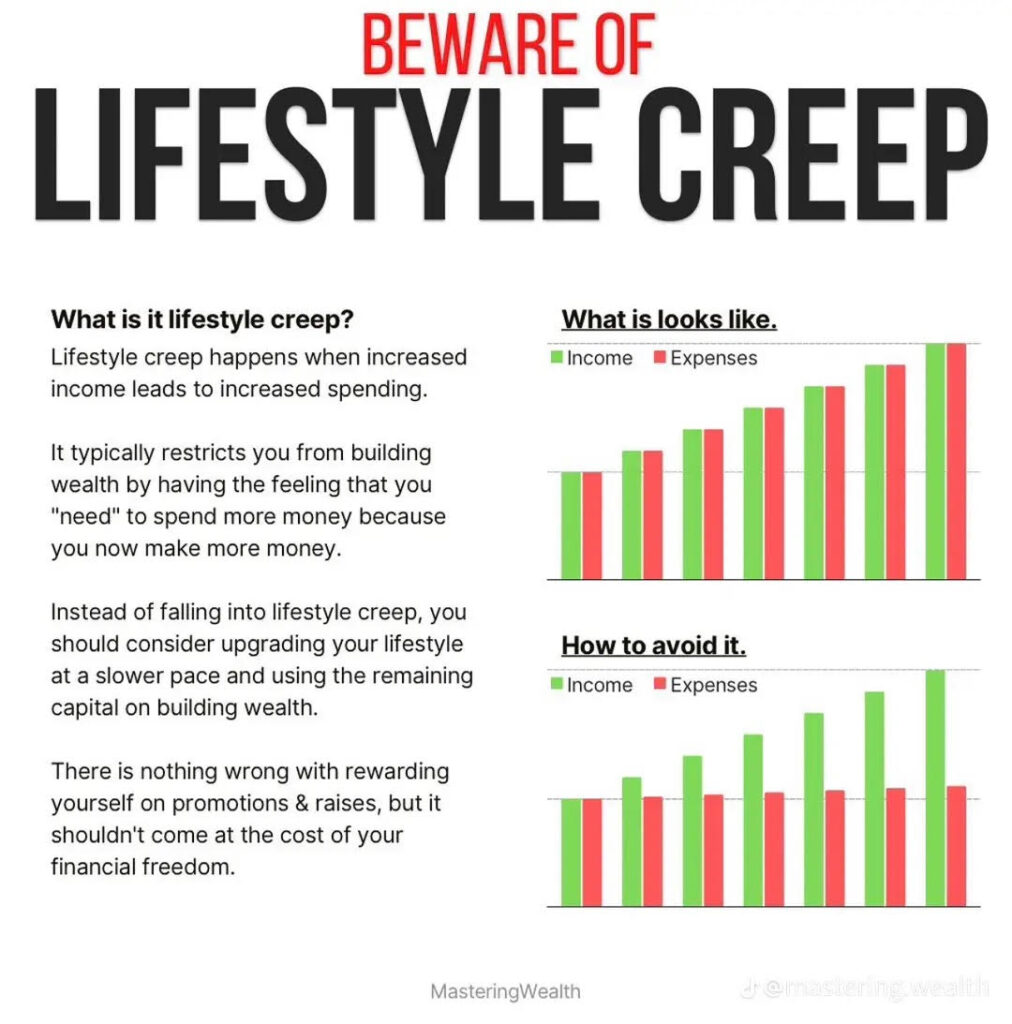

Picture this, an educated couple moving in together. They begin to save money for a house as they realize they have 2 well-earning incomes. With their increased revenues comes an increase in expenses as they start to pay more taxes. They buy a new house which creates new property tax, purchase furniture with credit for the home, and eventually have a kid.

This is what is known as lifestyle creep.

They are now in the rat race.

The rich invest in assets that make well over their expenses and repeat.

Rich Dad argues that although controversial to some, buying a home that will take 30 years to pay off may not be a real asset. There is a loss of high-maintenance capital, which could have been used to pay for expenses related to a home. Most importantly, people lose time. They need more time to invest in other assets.

Your assets should always be making more than your expenses, a formula that will never let you be a part of the rat race again. Once your assets earn enough to cover your costs, you reinvest your income into those assets and repeat the cycle.

An example of assets is seen below, such as:

Bonds, selling real estate, stocks, a property rented that does not exceed expenses, your own business that does not require you to be there, Notes (IOUs), royalties, or anything else that has value and actually appreciates.

Concentrate on buying assets and keeping expenses and liabilities to a minimum. Please only take on more debt if you have an investment that makes more money than it.

“If you have dug yourself in a hole,– stop digging.”

Lesson 3: Mind Your Business.

“Financial struggle is directly the result of people working for someone else.”

The mistake people make is only focusing on their profession, which is working for someone else. Many need to be more mindful of their business which is directly growing their assets column and tends to only focus on increasing their income statements, i.e., raises and bonuses.

Rich Dad recommends keeping your regular income job but buying assets that will grow, not liabilities that have no value in the long run. He knows the rich buy luxuries last, and the poor buy them first. True luxury is when your assets column could buy it for you. This may mean waiting a long time, but this is better than using your income when you still have many expenses.

Included in minding your own business is discovering your own way, as I detail in another blog post you can find here. Rich Dad knows many want to be rich but don’t want to struggle. When starting a business, you will often find yourself losing motivation, and that motivation or “why” will keep you going. Your why should be implemented into your assets column because this is where your burning passion for continuing stems.

Lesson Four: Pay yourself first.

One of the most important strategies taught in the book to sharpen your financial IQ is paying yourself first. Contrary to what you may think this means, this does not mean buying luxuries right when you are paid. It actually means the opposite.

When you get paid, automatically invest this money into anything that could be classified as an asset. Do this before paying your actual bills.

You can still pay your bills but learn to manage your expenses and assets this way to make yourself think of another way to create income. You will never learn to grow your financial IQ if no risks are involved.

That is why the taxman collects taxes right when you are paid and not at the end.

They know many of us do not have the financial responsibility to save it until the end. So don’t be afraid to challenge yourself and grow that creative and money-making muscle.

Financial education is going to be the difference between a rich and a poor man. You can be the hardest worker out there, but if you do not have the skills and knowledge to retain and reinvest your money you are limiting your potential. So what did you learn today?

To sum it up:

- Use your emotions to think, don’t think with your emotions.

- Your financial education is a far better asset than money.

- Mind Your Business.

- Pay yourself first.

If you liked this book summary, find a collection of other summarized books with critical points to save you time in your financial journey. Blinkist offers a free trial in which you can save money and time.

If you want your own copy, feel free to buy it on Amazon with my affiliate link and read the rest of his financial tips which are a gem changer for new entrepreneurs.

If you’re all about the details and would like to listen to the complete book and capture some real-life examples of Rich Dad Poor Dad while on the go, sign up for Audible, which gives you a free monthly token of any priced book monthly.

No responses yet